What + When + Where = The Formula to Hack Your Tax Bill

|

Whether you're a high-earning W2 employee 👨🏭 or crushing it as a small business owner 💆♂️, getting smart about tax follows the same formula:

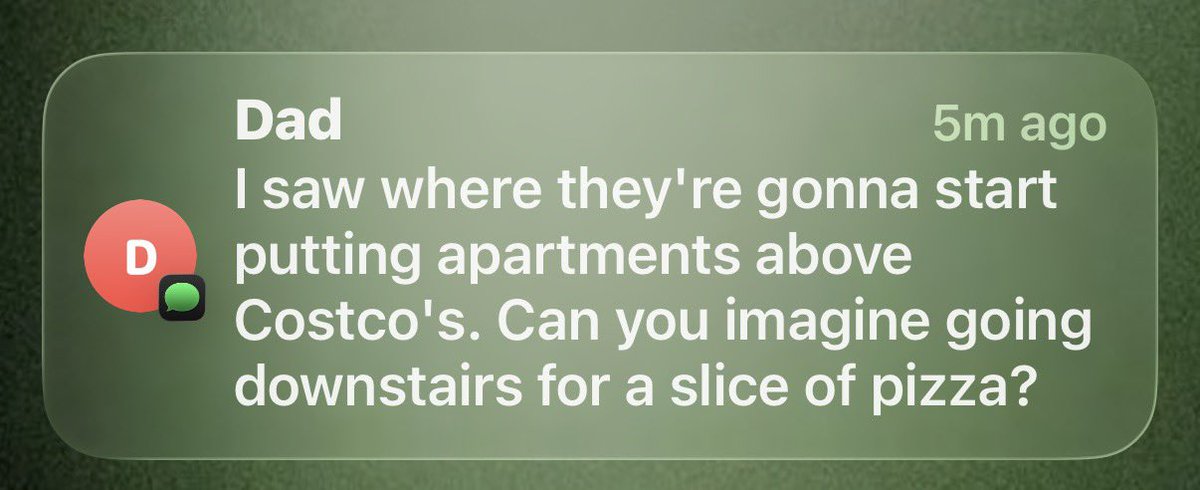

What - Spending SmartTax is a penalty for spending money on the wrong things. ⚠️ If you want to save taxes, you need to know what types of spending will have the highest tax-ROI. Spending money on equipment 🏗️ for your business will have a higher tax-ROI than spending money on a vacation. 🏖️ Giving money to a charity will have a higher tax-ROI than giving money to your kids. 🚼 I'm not a "let the tax tail wag the dog" guy, though. 🐕 And by far, most business owners (and high earning employees) let tax dominate their energy more than it should. But if you're looking to save money on taxes, know that you need to start with the What. When - Timing SmartThe best example of this concept is in a strategy called "bunching" of deductions. 🫂 This happens when a taxpayer is pretty close to the standard deduction every year. What we do is pay "itemizeable deductions" like property tax bills or large charitable donations in the same calendar year - 📆 for example on January 1 and then again on December 31. This concentrates the tax impact into one year to get well over the standard deduction in one year, and then well under it the next. It gets you the most bang for your buck. 💵 We also pay close attention to timing when a taxpayer (like a business owner) has swings 🛝 in their income between years. High income years mean we search for more deductions - as the deductions are saving tax paid in a higher tax bracket. 🔝 The opposite is true for lower income years. In those years, we defer deductions and accelerate income (think Roth contributions). ⏬ Where - Source SmartNot all money is the same when it comes to tax. 🙅♀️ So when we know what we want to spend and when to do it, the last step is to make sure we're using the right source. Back to itemized deductions for the example. If you want to donate $100,000 to a charity, there are a few ways to do this - but some are smarter than others. Say you've held stock for a few years that has massively appreciated. 📈 You could sell that stock, pay capital gains tax (23.8%), and donate the $100,000 out of what's left. Or, you could actually donate the appreciated stock itself. Doing this eliminates the capital gain on the sale of the $100,000 of stock while still yielding you the full value of the donation. 🤯 When it comes to businesses, the "source" is all the more critical. If you're using debt to buy an asset that you can depreciate, using a S-Corp to do that isn't always the best idea. 🏢 Partnerships are much better for using debt to acquire depreciable property. The TakeawayThese are the moving pieces to nail down if you want to get smarter about taxes in 2026. Tax strategy is more than knowing random tricks and loopholes - it's thinking in systems and knowing when to use which bucket of strategies. 🫡 Meme Cleanser 🧼

Want to read previous issues? Click here. |

The Plug [Newsletter]

I've been a CPA for nearly 20 years - serving private small business and real estate the entire time. I take the lessons learned in serving and now running a small business and share them here. For business owners, investors, and advisors looking to lower their cost of capital, subscribe for delivery straight to your inbox 👇 Also on YouTube at PlugAccountingandTax!

I am convinced that Anthropic ("Claude"), ahead of their IPO this year, is engaging in major guerrilla marketing. 🦍 Paying X-influencers to go on and on about how much their work is changing with: swarms 🤖, Ralph Wiggum loops ↩️, autonomous agents 👨💻, clawdbot on Mac Minis 🤏, etc. Most of the examples I've seen are basic admin tasks 🤷♂️ and not at all intriguing to me from a real impact point. I've personally spent the last 4-5 months overhauling processes within our firm with AI that I...

Over the last week I, along with 10 million others 👀, saw Dan Koe's X article on how to change habits realistically. If you didn't see it, it's worth the read ⤵️ DAN KOE @thedankoe http://x.com/i/article/2010742786430021632 4:31 PM • Jan 12, 2026 3326 Retweets 29272 Likes Read 474 replies This resonated because one theme that constantly comes up in new client calls is a dissonance of tax efficiency. Business owners are unsure if they are being the most efficient they can be and want help from...

This is it. We've reached K1 season again 📆 - where returns are rushed out before March 31 only to sit with the LP's CPAs until October 14th at which time all the questions come. But how can you, as either a LP, GP, or an advisor, look at the K1 in March and tell if something is off? 🤷♂️ I'm glad you asked. Today, we're jamming on 5 things ✋ to check when you first get the K1: Debt classification and allocation Distribution and contribution amounts Capital account ending balance QBI allocated...