Tax Structuring ≠ Coding 💻: 3 Ways to Do Stupid Stuff Right

|

I am convinced that Anthropic ("Claude"), ahead of their IPO this year, is engaging in major guerrilla marketing. 🦍 Paying X-influencers to go on and on about how much their work is changing with: swarms 🤖, Ralph Wiggum loops ↩️, autonomous agents 👨💻, clawdbot on Mac Minis 🤏, etc. Most of the examples I've seen are basic admin tasks 🤷♂️ and not at all intriguing to me from a real impact point. I've personally spent the last 4-5 months overhauling processes within our firm with AI that I believe is just now starting to impact our bottom line - but it's been a slow, iterative process. ⌛ So the question remains why is AI having such an outsized (even if it's overblown) impact on coding and technology compared to [insert] industry? The answer, I believe is this:

> The coding industry is built on a standard language, with a very tight and immediate feedback loop

> When you hit "go" it's very quick to see if the program or website looks and runs like you wanted

> Code may get bloated, but it still accomplishes it's intent on tight feedback loop

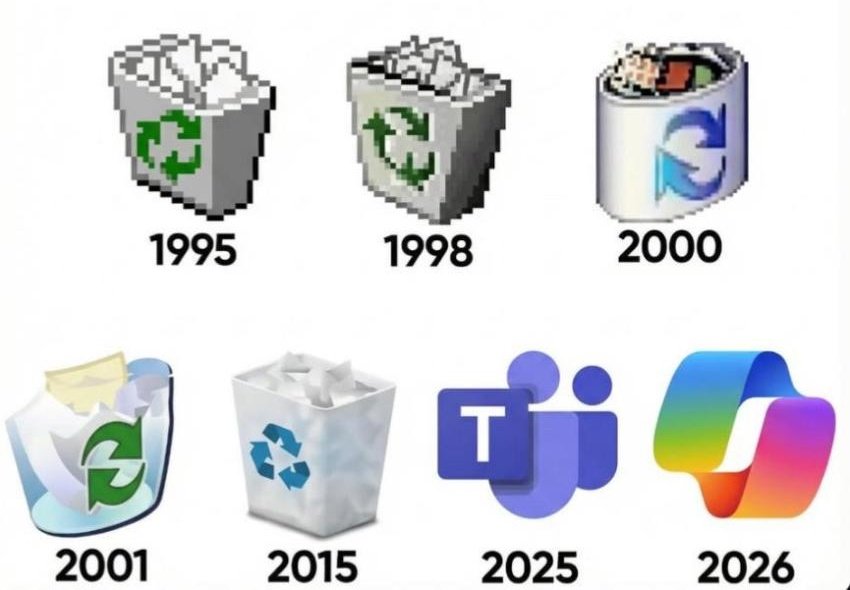

That's not how tax works. It's very possible to do stupid things with taxes very correctly. To boot, the feedback loop is not tight at all for the highest impact decisions. 🐌 Upwards of three years while you wait for an audit notice on significant positions. Rant over. Let's prove the point by looking at a few real life examples of how you can do dumb things correctly in tax. Entity Selection - Technology Start-upYou have a great idea for an app - join the club lol. 💽 But in your rush to get to market, you decide to form an LLC yourself so you can raise money from a few friends faster. When it's time for taxes, you look at your EIN document and see that you're supposed to file a partnership return (multi-member LLC default). You do that - also on your own - and think damn, those CPAs are a racket. Rinse and repeat this while we grind, fam. 🤝 Year 5, your app goes viral and you get an offer for $15,000,000. LFG. 🚀 During tax due diligence, the buyer asks "out of curiosity, why you didn't elect to be a C-Corp instead?" 🫣 As a C-Corp, under QSBS, the $15 million (basically all gain) would be non-taxable. Instead, as a partnership, you're paying 20% capital gains tax - or $3,000,000. 😧 So even with the partnership returns being filed timely and accurately, it was still the wrong choice. Deductions - Knowing What's AllowedYou buy a rental property and start your journey to passive income freedom, baby. 🔥 And still hell bent to save $2,000 in filing costs, you file your own return - reporting the rental income on your personal return. Only thing is you forget to take depreciation expense - for 7 years. 🏠 And here's the kicker: the IRS doesn't care about your deductions. They only care about your income. 🔍 So they don't audit you to correct that. "All good man, I'll just have higher basis when I sell," you think to yourself. 😎 But that's not how it works. 🙅 When you sell a property, the basis is reduced by "depreciation allowed OR ALLOWABLE." So you still reduce the basis in the property by the "phantom" depreciation not taken. Again, the rental income reporting was "correct enough" - but dumb. Tax Deferral - Tenancy in Common OptionAn apartment building you bought with a few partners 10 years ago is set to be sold. You're going to make a lot of money. ✋ Only one hiccup though. Some partners want to roll the gains into a new property, 🎢 and some want to cash out. In your search though ChatGPT Pro-Max-Ultra, you see that a 1031 exchange can only be done with identical ownership. Since some of your guys want out, you give up on it. You sell, distribute the cash, pay the tax, 💸 and those that want in go back into the market with 23.8% less capital (after tax). That's not "technically" wrong. But ChatGPT failed to walk though the Tenancy in Common (TIC) option. The TIC would allow some sellers to 1031 their proceeds into a new property - protecting their capital from tax leakage - while others that wanted out, got out. This takes timing, planning, structuring - and the IRS could care less which one is done. As long as you do them right. The TakeawayIn the age of automation, it's going to be very easy to do stupid stuff correctly. Especially in tax planning. To avoid these traps, you need to know where to look - structuring, elections, timing. 👈 And remember that the best tax strategies aren't in the instructions or on the IRS website. They're learned from decades of dealing with government agencies and knowing what to say when they ask the questions they have to ask. If you want to get tight on tax planning, talk to a pro. 🫡 Meme Cleanser 🧼

Want to read previous issues? Click here. |

The Plug [Newsletter]

I've been a CPA for nearly 20 years - serving private small business and real estate the entire time. I take the lessons learned in serving and now running a small business and share them here. For business owners, investors, and advisors looking to lower their cost of capital, subscribe for delivery straight to your inbox 👇 Also on YouTube at PlugAccountingandTax!

Over the last week I, along with 10 million others 👀, saw Dan Koe's X article on how to change habits realistically. If you didn't see it, it's worth the read ⤵️ DAN KOE @thedankoe http://x.com/i/article/2010742786430021632 4:31 PM • Jan 12, 2026 3326 Retweets 29272 Likes Read 474 replies This resonated because one theme that constantly comes up in new client calls is a dissonance of tax efficiency. Business owners are unsure if they are being the most efficient they can be and want help from...

This is it. We've reached K1 season again 📆 - where returns are rushed out before March 31 only to sit with the LP's CPAs until October 14th at which time all the questions come. But how can you, as either a LP, GP, or an advisor, look at the K1 in March and tell if something is off? 🤷♂️ I'm glad you asked. Today, we're jamming on 5 things ✋ to check when you first get the K1: Debt classification and allocation Distribution and contribution amounts Capital account ending balance QBI allocated...

One of the most confusing parts of the recent tax bill that passed in July was the different effective dates. 📆 Some parts were effective retroactively, some immediately, and others not until 2026. With a new tax filing season barreling down upon us, I wanted to share a reminder of the items that impact 2025 👇 - with a focus on small business and individuals. Note this is not a comprehensive list, so as always chat with your tax pro for specific impacts to you! Individual Provisions No Tax on...