Reminder of Changes to 2025 Tax Filings 📆

|

One of the most confusing parts of the recent tax bill that passed in July was the different effective dates. 📆 Some parts were effective retroactively, some immediately, and others not until 2026. With a new tax filing season barreling down upon us, I wanted to share a reminder of the items that impact 2025 👇 - with a focus on small business and individuals. Note this is not a comprehensive list, so as always chat with your tax pro for specific impacts to you! Individual ProvisionsNo Tax on Social SecurityTerrible name - decent policy. This provides senior citizens 👵 (over 65 before end of that tax year) with an additional $6,000 deduction. It phases out quickly between $150k and $250k Married Filing Joint modified adjusted gross income. Worth noting that you don't need to itemize deductions to claim this. So if you review your parents return, be sure to look for this. It will be a good help to many seniors who would like to keep their benefits instead of pay tax on them (again). 💸 No Tax on TipsAgain - terrible name. This creates another deduction that even those who don't itemize can claim. The only downside, besides increasing our crushing national debt, is that treasury (the government) didn't change the W2 forms to help tax pros (like me) figure out how TF to report this. 🤷♂️ This, in addition to the Overtime deduction below, will add to the cluster F that will be the 2026 tax season. I digress - this is a deduction of up to $25,000 per individual for tips received. It applies to specific industries only, to prevent funny business. 💈 It also phases out based on adjusted gross income between $300k and $550k for married filing joint. If you, or your child, receive tips from their job then it's worth digging in how to pick this up as an additional deduction. No Tax on OvertimeYou get it by now - this is a deduction. Bad name, yada yada. 😶 Like the Tips deduction, no itemizing needed. But it is calculated slightly different. It's a deduction of $25,000 for married filing joint, or $12,500 for single filers. Same phaseouts as Tips. All based on qualifying overtime - which isn't as straightforward as one may think. 😵 If you receive time and a half for overtime, it's the "half" that is eligible income to drive this deduction. Same advice as Tips, if this applies to you or a loved one, get professional help. ☝️ Car Loan Interest DeductionThis one is also not necessary to itemize, but comes with equally confusing requirements and nuance I'm excluding. It's a maximum $10,000 deduction for car loan interest for purchasing new cars final assembled in the US in 2025. 🚗 Notably, it phases out over $200,000 of married filing joint income. But thankfully car dealerships and financiers are required to ship 1098s to help navigate - our thoughts and prayers are with them. 📝 SALT Cap Increase to $40,000SALT is back on the menu, boys - kinda. It increases from $10,000 to $40,000 starting 2025. 🧂 It's also slated to increase 1% each year until it reverts back to $10,000 in 2030. 🙄 The income phaseout is also higher at $500,000 to $600,000 for married filing joint. And the minimum stays at $10,000 after the phaseout. Note that if the $40,000 wouldn't cover your state income tax 🗺️ due to business income, or if your business income puts you over the phaseout, a PTET strategy is a popular workaround and is still in play. Business ProvisionsBonus Depreciation Back to 100%100% bonus depreciation is back for qualifying assets purchased and placed in service ON OR AFTER January 20, 2025 (Inauguration Day for anyone wondering). 🇺🇸 🦅 Section 179 deduction is also increased to $2.5 million per entity - but can't drive a loss in a business like bonus depreciation can. 📠 163(j) Interest Expense Limitation Add-backThis is one only the realest of the real ones know / care about. 🤜 🤛 In 2017, one of the revenue raising items was to limit how much interest expense can be deducted. And it referenced other sections that inadvertently included small partnerships with LP investors. The impact was that many real estate syndications were limited on how much interest expense they could deduct - especially in 2022 when depreciation was no longer eligible as an "add-back" to the calculation. This punished those businesses utilizing cost segs and highly leveraged assets. 🏧 In 2025, however, we get the add-back back. Which will be useful given the expensive credit cycle we're in. R&D ExpensingThe requirement to amortize (capitalize and take a deduction over time) research and development costs over five years has been repealed for domestic expenditures (foreign R&D still gets hit). 🔬 Businesses can now once again claim immediate 100% expensing for U.S. based R&D costs. Small businesses may also be eligible for retroactive relief dating back to 2022. For what it's worth, there were likely a lot of small tax practitioners who ignored this and ended up round tripping the entire tax code. 😅 2026 and BeyondThat covered the 2025 important items I care about, but what's up ahead in 2026?

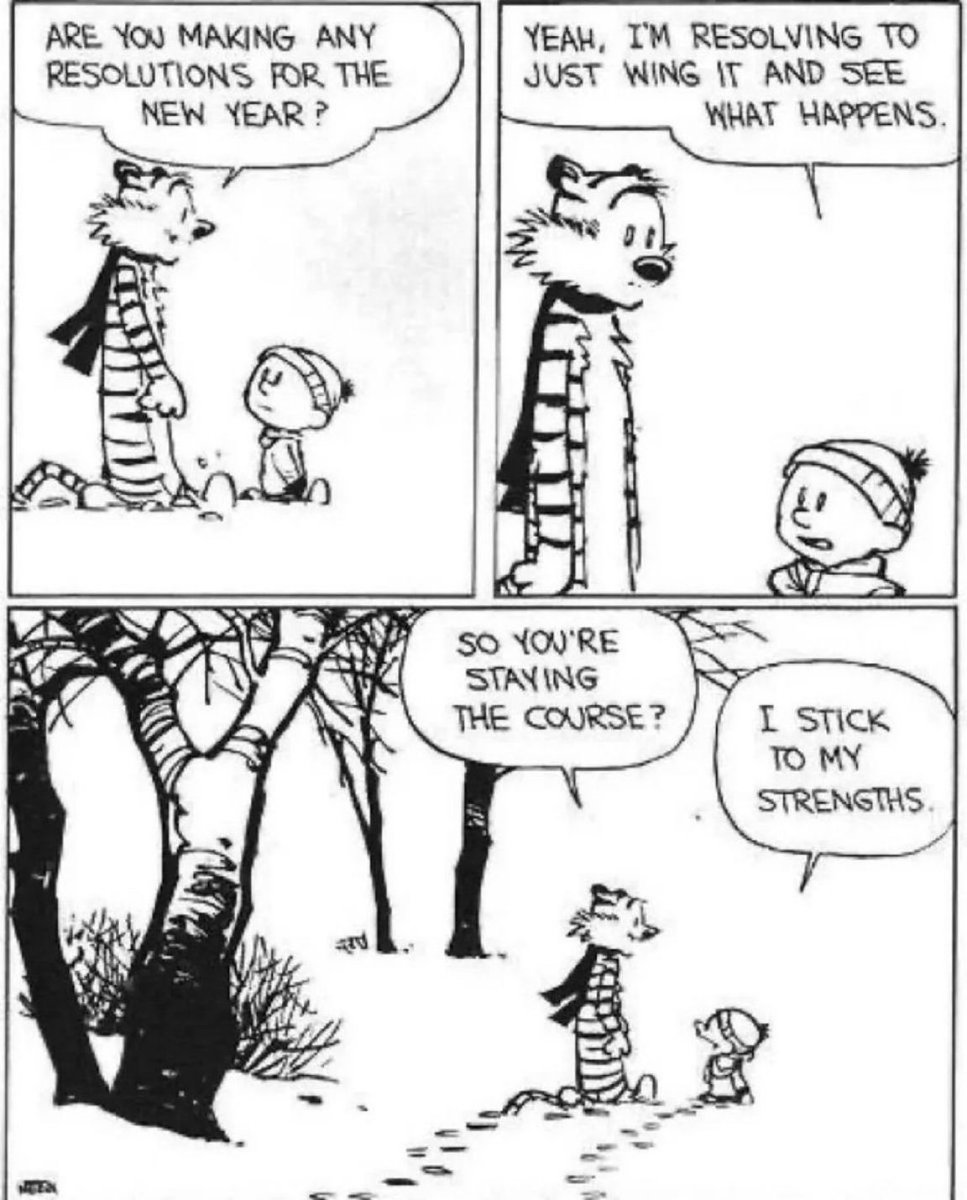

The TakeawayAlways talk to a tax pro for your specific situation. I can't fit every relevant and nuanced bit of information in 1,000 words or less. Have a great 2026! 🎉 🫡 🔥 Meme Cleanser 🔥

Want to read previous issues? Click here. |

The Plug [Newsletter]

I've been a CPA for nearly 20 years - serving private small business and real estate the entire time. I take the lessons learned in serving and now running a small business and share them here. For business owners, investors, and advisors looking to lower their cost of capital, subscribe for delivery straight to your inbox 👇 Also on YouTube at PlugAccountingandTax!

Every year, countless small business start-ups hear about the Qualified Small Business Stock (QSBS) exclusion and lock in 🔒 on that being their ticket to a tax-free seven + figure exit. 💰 And for some, it is. But a bigger percentage of others never make it there. Or worse, they get there and don't have a qualifying stock sale. 🫣 Today, we're talking about one way to bail out of a QSBS set-up without being double-taxed to death. QSBS Background For anyone not in the know, QSBS is an exclusion...

If you own multiple short-term rentals (STRs), 🏡🏠 you need to Ctrl+F in your 1040 for your "grouping election" or "469." This lets you combine these properties into one activity so your hours count together for material participation. And by qualifying for material participation, you can use those losses against your other income. 🔀 The problem is there are two different elections, and a lot of tax pros file the wrong one (if they file one at all). The Choices The two elections are Reg....

Whether you're a high-earning W2 employee 👨🏭 or crushing it as a small business owner 💆♂️, getting smart about tax follows the same formula: What: 🤷♂️ spend money on the right things + When: ⏰ spend money on the right things at the right time + Where: 🗺️ spend money on the right things at the right time from the right accounts What - Spending Smart Tax is a penalty for spending money on the wrong things. ⚠️ If you want to save taxes, you need to know what types of spending will have the...