Million Dollar Checklist for Operating Agreements 💰

|

CPAs and tax preparers (shout out to all my EA friends) get a bad wrap for adding zero value to their clients. So when we have a chance, we have to be ready to lay the pipe and bring it. 💪 One of the best ways I've done this for my real estate (and small business) clients is through a good scrub of their operating agreement (OA) - with practical suggestions and changes. If you are the client, this is an incredible way you can bring value to your LPs as well as save yourself some tax - by knowing exactly what language and terms should be in your OA. 🗃️ Today, we're going to go through the three tax levers of operating agreements I look for:

Let's go 🚀 Capital StackThe star of the show in OAs is income and loss allocation method. Few CPAs are aware that there are two different types of methods most commonly used ✌️ - safe harbor and target capital. And even fewer know which type should be used when. The short rule is this:

Losses flow differently between LPs between the two methods - and your goal as a GP is to meet investor expectations. 🤲 I've separately created a 13-page detailed checklist for each of the 11 OA items I look for that have saved my clients millions in tax - and yes it's paywalled to help offset the costs of this newsletter. But for the next week, use the code "Target" and get it for $50 ⤵️

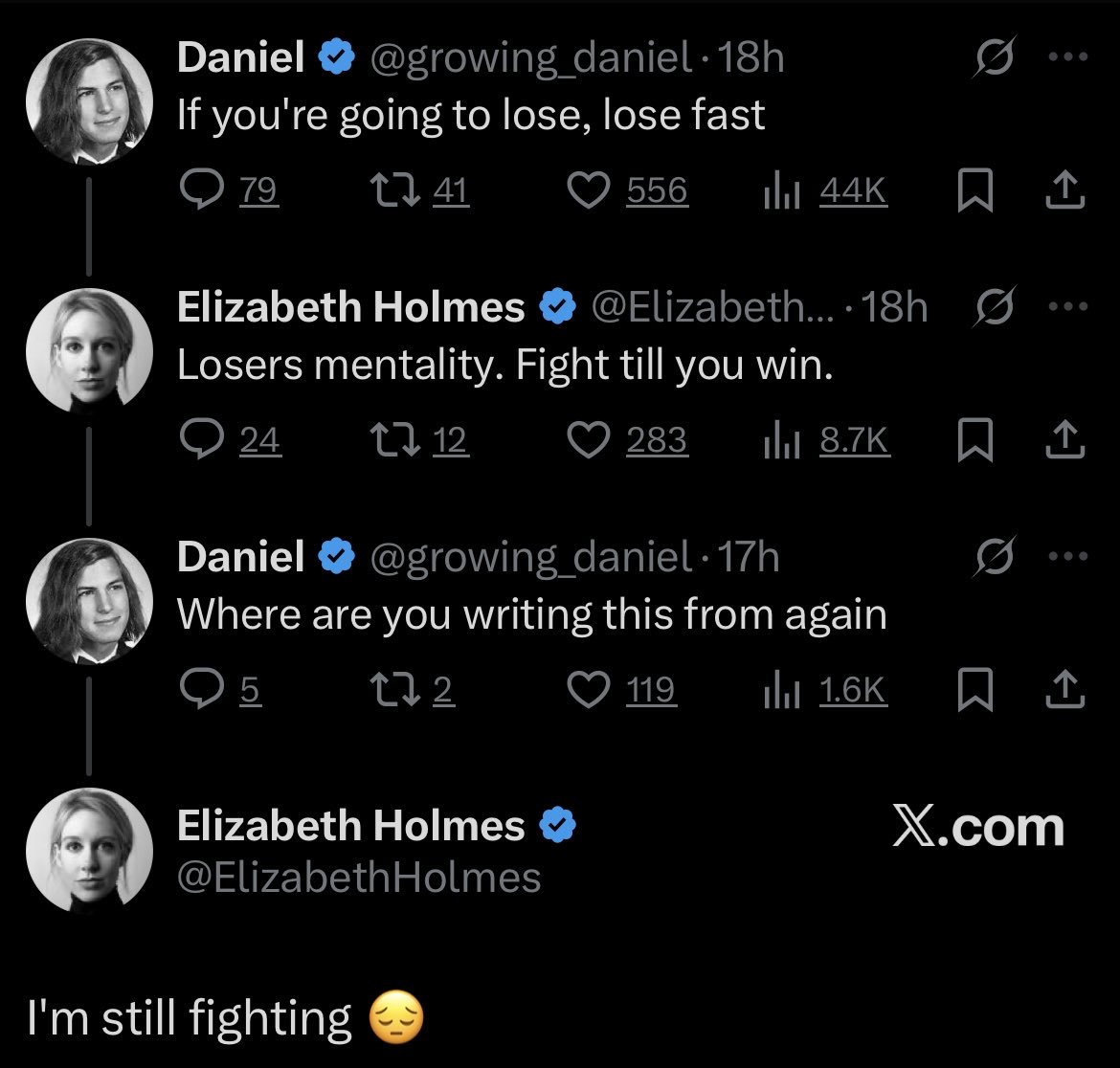

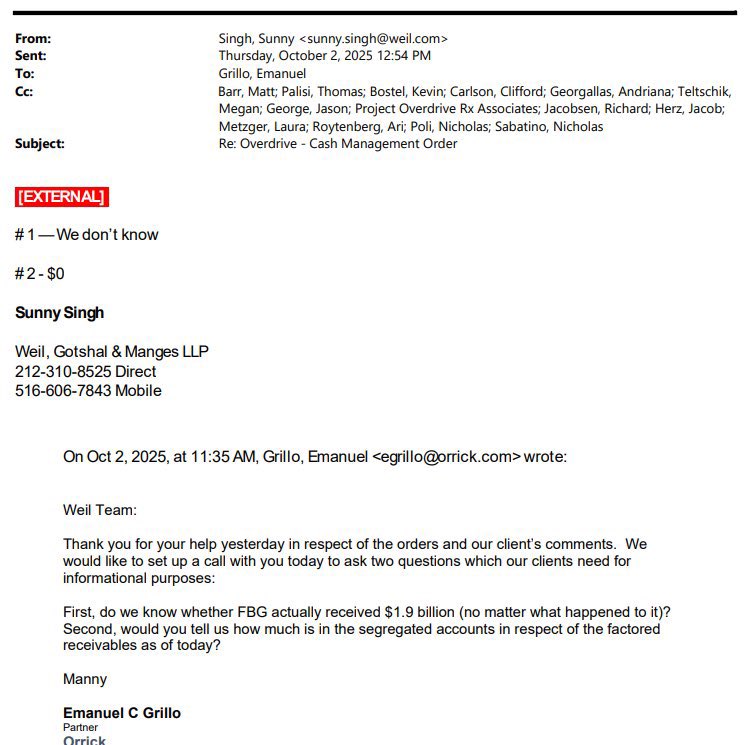

Preferred returns to investors offer another wrinkle to consider. ✍️ If payment of pref is not dependent on income of the business, it is more likely to be treated as a guaranteed payment to those partners (for use of capital for my tax nerds). This can create a mismatch of income to those investors - as guaranteed payments are subject to self-employment tax. 😠 As far as debt goes, when you're finally able to stabilize and remove the guarantee the OA should include basic minimum gain and chargeback provisions so the nonrecourse debt allocations are respected. 🫡 Especially for real estate investments where Qualified Nonrecourse Debt is "at risk" and much more valuable to investors. Check out the Checklist for more about how the capital stack impacts key terms. EventsA promote is just a special allocation of distributions (and corresponding tax income) to a GP (sponsor, etc.) for having met certain financial goals. When those goals are met, and distributions made, the last thing anyone wants is to have that income characterization challenged. 🤷♂️ But that's exactly what can happen if bad allocation language exists. Another way to protect the promote is to have "safe harbor" language included (and followed) in the OA. Specifically check out Rev. Proc. 93-27. Basically, the recipient of the promote can't be getting into an expected stream of income already - or he'll subject his profits interest to taxation. 🧾 Speaking of promote - some OAs will bake in a promote crystallization clause that can cause phantom income to unsuspecting GPs. The crystallization is a mechanism that grants the GP real equity (taxable) at a set valuation for the stabilized property. The tax advisor should consider this when planning around the cost segregation study and consider marrying those two events in one year 💍 to minimize tax burn. Best PracticesSome advice is best no matter what capital stack or event likelihood exists. Things like not making your tax preparer make certain elections 👮♂️ - like a §754 election, or an accrual basis tax filing. Forcing our hand into certain types of methods really prevents solid tax planning flexibility. So avoid these. Also, when your entity is a S-Corp (LLC taxed as S-Corps included) or a Tenancy in Common (TIC) - you are dealing with a whole other level of risk and compliance. 🚨 Bad S-Corp language can blow up S-elections, leaving you with a C-Corp. Bad TIC language can blow up 1031-deferred gains, leaving you with a taxable partnership. Again, check out the Checklist for the details on what to look for in those cases ⬆️ The TakeawayIf you have a chance to bring valuable insight to your clients or investors with a better and stronger operating agreement, you need to take it. And while having the agreement language right is just the first step to actually following it, it's a step that really matters.🚶♂️ If you're not interested in paying for the Checklist above, I always offer my services to consult and read OAs and give feedback - but it's more than $50 😉 🫡 Watch the YouTube version here! 🔥 Hottest Finance Posts This Week 🔥

Want to read previous issues? Click here. |

The Plug [Newsletter]

I've been a CPA for nearly 20 years - serving private small business and real estate the entire time. I take the lessons learned in serving and now running a small business and share them here. For business owners, investors, and advisors looking to lower their cost of capital, subscribe for delivery straight to your inbox 👇 Also on YouTube at PlugAccountingandTax!

Freakonomics is a classic read about initially uncorrelated outcomes. 📖 One of the more memorable correlations is how diapers and beer were purchased together at grocery stores. It seems weird at first until you think about young dads at the store to buy diapers and likely not being able to go out to a bar and drink. 🍺 Tax strategy works the same way. 👆 Business owners and tax pros alike can approach each tax strategy as a standalone tool. A Roth conversion is a part of retirement planning 👨🦳...

Ten years ago, I met with my business development partner and shared with him this idea of documenting and sharing the tax strategies each client was using. 📝 It would make us intentional strategists - having to commit to strategies and execute on them. The idea floundered in that firm but it stuck with me. Fast forward to 4 years ago when I left Baker Tilly and shared the same idea with my now partner, Mitchell Baldridge. We doubled down into the idea and have built out work-up's and...

A powerful unlock 🔐 in small business is owning your own real estate. It protects you from rent increases and inflation 📈 It accretes to your balance sheet the value of a reliable tenant (yourself) 🤝 It opens up additional and creative ways to finance business operations with tax benefits 🤑 But that last point isn't a slam dunk. Section 469, the passive activity loss rule from 1986, treats all rental real estate as a passive activity by default. Any depreciation losses from that real estate...