Drop the S(Corp), It's Cleaner 👌

|

I'm asked this question probably 100 times every year: "Should I be a S-Corp?" 🤷♂️ A tiny fraction of the answers do I ever get paid for - family, friends, new client prospects. Most of the time they get talked out of it or don't get the confirmation they were looking for it and we never talk again. So I spent some time thinking it through and shared a full blown "Pass-through Entity Selection Decision Tree" last 👉 week. If you can't find it, it's right above the degenerate Twitter Posts at the bottom of the email. This week, we're going in on the details - the 7 Factors That Drive Tax Entity Selection ⤵️ Active or InvestorFirst, I need to know what you want to do with this entity. Are you going to use it to run a business? 🧑🏭 Side hustle? Or just use it to invest in other businesses? 📈 The last thing you want to do is set-up a S-Corp HoldCo for your 25 $1,500 Angel investments. We'll come back to the two "investor" entity factors. What most conversations deal with are when the owner will be active - meaning being involved in the business. Income GenerationNext is how much income will you make in this business and when? The costs of a S-Corp return are:

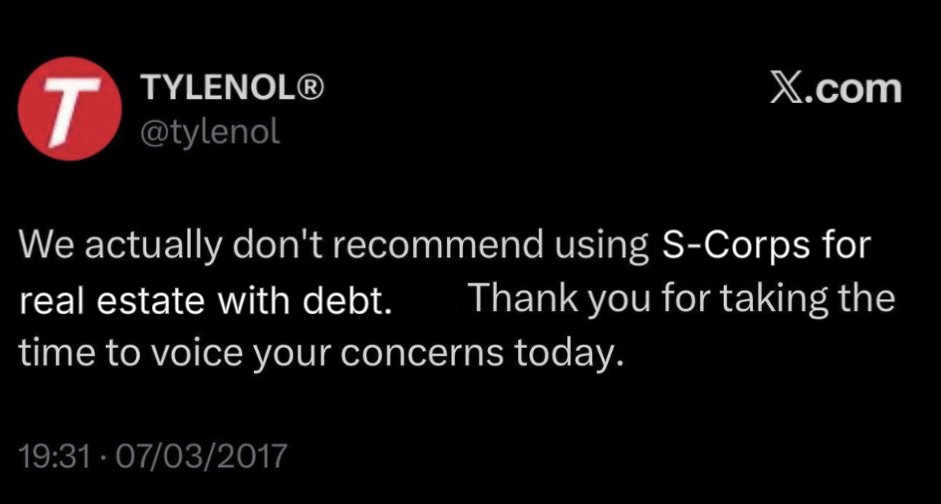

These are bare bones costs but already at $3,000 annually. So the tax savings should be more than this to make sense. ⚖️ If a S-Corp will make $50,000 in profit before paying an owner, then the savings would be basically break-even. If the argument is made that a "reasonable salary" is $30,000, then this is only a $3,000 self-employment tax savings ($20,000 profit distribution x 15.3%). And $30,000 is a pretty low reasonable salary. 🤏 That's why we set a number for when a S-Corp would even start to make sense - mine is $100,000 in profit before owner payments. Use of Leverage (Debt)Debt is a powerful tax planning tool. It's easy to mess it up with S-Corps. 🌀 Debt can be used to finance tax losses which can be used to offset other cash income. It can also be used as basis for tax-deferred (tax-free for the layman) distributions. 🏦 The best way to protect your "debt basis" is to keep the debt inside a partnership or single-member LLC (sole proprietorship). Use of Capital (Investors)You have to get this right. And if the question is "I don't know" or "maybe someday" then the answer is "yes, one day I will have other owners." 👩👩👧👧 Partnerships are one of the most flexible entities for tax purposes for several reasons - one of which is the fact that there are no real limitations on what entities can own a partnership (or LLC taxed as a partnership). Not so with S-Corps. C-Corps, most trusts, partnerships, non-residents are all invalid S-Corp owners. And the answer on going from S-Corp to partnership isn't just "check a new box." 🙅♂️ Changing entity types can result in phantom income that can kill an entire business. Balance Sheet Make-upIf you will have appreciating assets, especially those subject to debt - like real estate 🏠 - usually you go with either a partnership or keep it a single member LLC. These allow maximum flexibility for more advanced tax strategies like TICs with 1031s and restructuring for estate planning. 🧘♂️ If you have appreciating assets inside of a S-Corp, the value often gets trapped in there and limits how well you can use that appreciation to enrich yourself (or investors). Investment Entity - Liability LimitationsIf you're using this entity only as an investment entity, many times I've seen attorneys tell clients it's overkill. They have shared that if you are investing in a limited liability entity (LLC, LP, Inc., etc.) then you should be protected by that liability limitation so long as those rules are followed. I'm not an attorney - just sharing anecdotes. Talk to one about your specific case. Investment Entity - Estate Plan ImpactsIf you are deploying capital that is inside the purview of an estate plan (allocating capital that is inside a trust or family limited partnership owned by trusts) then there may be very good reasons to form a separate entity. 💰 I am also not an estate specialist. So anytime we start dealing with estate and trust work, I have to tell you to engage a professional in this area and follow their advice. 👨💻 Not Pictured - C-CorpsI didn't add in factors that would impact when I would advise a C-Corp. Mainly because it rarely comes across my desk in the world that I play (real estate and pass-through small business). But occasionally it will and here are some tells when I'll suggest it:

The Bottom LineTake a look at the download - and let me know if you're having problems getting it. I'd love to hear from you if this is helpful. As always, this is informational and educational in nature and should not be taken as blanket tax advice. Seek the professional help of a competent advisor. 🫡 This Weeks YT VideoA ranch deduction gone bad 👇 🔥 Hottest Finance Posts This Week 🔥

Want to read previous issues? Click here. |

The Plug [Newsletter]

I've been a CPA for nearly 20 years - serving private small business and real estate the entire time. I take the lessons learned in serving and now running a small business and share them here. For business owners, investors, and advisors looking to lower their cost of capital, subscribe for delivery straight to your inbox 👇 Also on YouTube at PlugAccountingandTax!

Freakonomics is a classic read about initially uncorrelated outcomes. 📖 One of the more memorable correlations is how diapers and beer were purchased together at grocery stores. It seems weird at first until you think about young dads at the store to buy diapers and likely not being able to go out to a bar and drink. 🍺 Tax strategy works the same way. 👆 Business owners and tax pros alike can approach each tax strategy as a standalone tool. A Roth conversion is a part of retirement planning 👨🦳...

Ten years ago, I met with my business development partner and shared with him this idea of documenting and sharing the tax strategies each client was using. 📝 It would make us intentional strategists - having to commit to strategies and execute on them. The idea floundered in that firm but it stuck with me. Fast forward to 4 years ago when I left Baker Tilly and shared the same idea with my now partner, Mitchell Baldridge. We doubled down into the idea and have built out work-up's and...

A powerful unlock 🔐 in small business is owning your own real estate. It protects you from rent increases and inflation 📈 It accretes to your balance sheet the value of a reliable tenant (yourself) 🤝 It opens up additional and creative ways to finance business operations with tax benefits 🤑 But that last point isn't a slam dunk. Section 469, the passive activity loss rule from 1986, treats all rental real estate as a passive activity by default. Any depreciation losses from that real estate...